How sporting goods brands can master the new normal and leap to a direct model.

The last couple of years have been hard on all brands. But it’s been especially hard on companies that sell to athletes and casual sports fans. Brands that mostly sell via department stores, big-box stores, and other retail channels are facing new challenges and rivals. Those who can adapt and sell direct-to-consumer (DTC) will reap major rewards and ensure a future-proof brand experience.

This post is the first in a series. I'll explore the changing market landscape for global sporting goods brands. I'll also explain how CoreMedia builds a sustainable path to direct-to-consumer sales.

The Future is Direct-to-Consumer

2020 was tough on sporting goods brands. Consumers have given up in-person shopping. Retail sales have plunged. According to the NPD Group, fashion footwear sales fell 24% in Q1 2020[1]. This produced an explosion in online sales for companies with the right technology and business vision. According to McKinsey and Co., year-over-year eCommerce sales in the United States more than doubled to almost 35% in 2020[2].

The shift has been a boon for pure-play DTC brands. With lower barriers to entry, these high-growth, digital-first brands have forged unique relationships with a community of sports fans, eager to remain connected to their athletic passions and maintain their workout schedules. DTC sporting goods brands like Peloton, Lululemon, Bombas, Allbirds, and Outdoor Voices have all changed the way that consumers shop for equipment, apparel, and other products. Popular non-sports-related consumer brands include Glossier, BarkBox, Warby Parker, Blue Apron, Honest Company, Dollar Shave Club, and the ubiquitous bed-in-a-box brand, Casper.

Sporting Goods is a Natural Fit

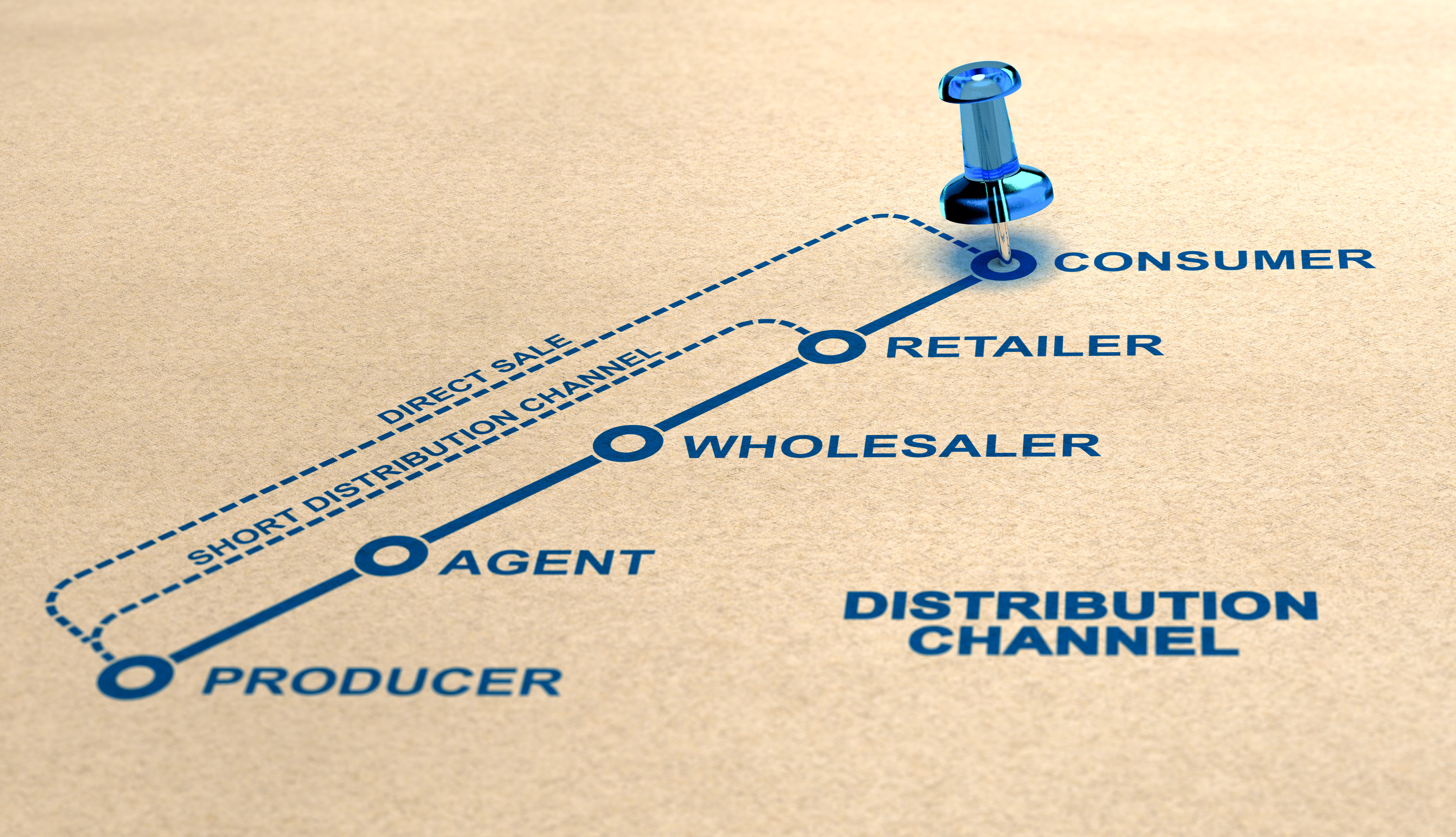

It’s no surprise that sporting goods brands have found success by selling directly. DTC reduces the gap between sellers and buyers. Consumers don't have to wade through a confusing landscape of resellers to find the products they need. DTC advertising is a perfect match for the hyper-focused mindset of the typical sports enthusiast.

Sports buyers are always looking for products to boost their performance. This applies to hiking, skiing, biking, running, surfing, mountain climbing, and more. While Covid-19 may have put a damper on pro sports, it only sharpened the appetite of the individual consumer wanting to transform lockdown into workout time.

Sporting goods brands are leading this shift. Nike recently pulled all its products from Amazon and Under Armour reduced its wholesale partner network by almost 3,000 distributors[4]. Footwear pioneer, Adidas, projects that DTC will account for half of its total sales by 2025[5].

Weighing the Pros and Cons of a DTC Strategy

A direct sales model is not an assured victory. This is especially true for brands with a traditional supply chain and brick-and-mortar retail model. Juggling many third-party middleman relationships for your retail stores can distract from your customer relationships. Athletes win when they have a strict training regimen. And traditional retailers win when they understand the costs and benefits of this approach.

The direct-to-consumer model is based on a simple consumer marketing equation. Step one is to balance the role of the wholesaler and physical retailer. Step two is to focus on a targeted set of online consumers. Brands that do this can increase their margins and invest in new technologies and aggressive marketing.

The benefits of DTC marketing and sales include:

- Attract new customers and expand marketing channels

- More direct relationships and improved customer service

- Shift marketing and merchandising quickly in response to consumer pressures

- Take control of your brand and the entire customer experience

- Enhance customer loyalty and improve social media engagement

- Stop worrying about end cap fees or retailer discounts

- Gather consumer feedback for new products and product lines

- Improve order fulfillment, customer support, and other post-purchase workflows

But these results can only be achieved if brands can overcome the challenges of this business model. These include high customer acquisition costs, customer retention difficulties, and agile competitors.

Traditional brands face additional DTC challenges. The future will be defined by DTC, but retailers still rely on channel partners for most of their revenue. They also have considerable logistical and infrastructure overhead. They need to forge new relations with consumers, but they also need to maintain their relationships with existing sales partners and target audiences.

Fortunately, it's possible to accomplish both goals. In fact, traditional brands might be in a stronger position than pure-play eCommerce startups to succeed at DTC.

The Ball is in Your Court

Direct sales are based on community, ubiquity, relevance, and experience. This means that traditional brands seeking to transition to a DTC model are in a good position. Not only do they start with stronger consumer awareness, but they also have an existing ecosystem that can deliver greater convenience to shoppers. By building on their traditional strengths and resources, they can gain a significant advantage over their more agile competitors.

The path to achieving the perfect balance between a traditional and a DTC business model involves creating a community of partners, customers, and athletic influencers. This community can deliver personalized, content-driven experiences across all digital channels to inspire, inform, and transact.

The following customer-facing tactics are just of few of the topics that we will explore in upcoming posts:

Chapter 1: Content-driven storytelling for hyper-targeted sales

Sporting goods retailers have already invested in content marketing to build customer communities in-store and online. They know a great deal about their customers. This includes their goals, performance metrics, and more. But many direct-to-consumer brands struggle to monetize first-party data while protecting end-to-end customer privacy. The key is to pair this customer data with inspirational content to deliver truly a targeted customer experience. Andy Katz-Mayfield, the found of Harry's sums it up this way: "What if we spoke to guys like, well, people?" The founders of Warby Parker did this by creating a compelling story based on the idea that glasses cost too much. But you can go further. It can even be extended to personalized products. Or allowing shoppers to try-on a product and return it if it's not their size. These customer experiences can be delivered via direct-to-customer channels, as well as B2B marketing portals.

Chapter 2: Blend content and eCommerce to deliver frictionless omni-channel transactions

Potential customers want online brand experiences that are integrated with eCommerce. Every interaction with a retailer should be an opportunity to learn, become inspired, and buy. Regardless of where a shopper encounters a brand, they should find a seamless, personalized opportunity to engage and purchase. This includes mobile apps, online marketplaces, direct-to-consumer brand sites, social media, and more. Product portfolios can be extended to support additional experiences – from clothes to workout music, from running shoes to exclusive fitness events. The possibilities are endless.

Chapter 3: Build a subscription-based loyalty loop for partners and consumers

Enduring relationships are based on more than price, selection, and availability. Once a true one-to-one relationship has been established with a customer, it can be extended to include other customers, social media influencers, and even retailers and other partners. Product quality is only part of the story. Customers also trust brands and their partners because of word-of-mouth and their network of athletes and experts. Glossier does this by investing in cosmetic influencers or "reps" who obtain a share of each deal they help sell. Other strategies include loyalty programs and subscription services. Some brands leverage the user-generated content that their customers post online. All this drives buyers back to the brand, increases cross-sell, and encourages customers to become social media advocates. The result is a cycle of engagement, influence, and loyalty.

We’ll explore each of these business-to-consumer topics in upcoming posts. Keep checking in to learn more about the DTC channel approach and how it can increase your year-on-year success - along with your retail partners. But first, check out our customer success stories. Find out how DTC brands like Deckers Brands (owner of Hoka One One, Teva, and Sanuk), leap over their competitors with customer-centric experiences and an improved direct-to-consumer marketing process.

Want to improve the shopping experience and have as big an impact as Warby Parker, BarkBox or Glossier? Give us a call. We’d love to talk with you about DTC brands.

Want to Read More?

Learn how CoreMedia is helping DTC companies improve every customer journey.

Visit our DTC to access additional case studies, solution guides, and more!

[1] https://footwearnews.com/2020/business/retail/shoe-sales-sandals-2020-npd-report-1202974129/

[5] https://www.adidas-group.com/en/media/news-archive/press-releases/2021/adidas-presents-growth-strategy-own-the-game-until-2025/